Updated: May 30, 2023

If you’ve ever filed a claim with your homeowners insurance company, you know how important this coverage is. When an accident or another type of damage occurs that’s covered by homeowners insurance, the coverage can be an absolute lifesaver. Paying out of pocket to fix problems with a home can easily exceed an available budget.

Like any type of insurance, with homeowners insurance, certain things are covered, and others are not. If your garage door gets damaged, you may be wondering if you can file a claim with your insurance company. Navigating insurance issues can be a little tricky sometimes, and that’s why we want to help make the process a bit easier. Below are some questions you may be asking yourself about filing an insurance claim for your garage door.

Things to Know in This Article:

Does Home Insurance Cover Garage Door Problems?

Some home insurance policies may cover your garage door, and this is something you’ll need to discern before signing a policy. Before filing a claim, check your policy to evaluate your coverage. Keep in mind that different policies will cover different accidents and situations. You may need to pay more per month for more extensive coverage or sign a policy with a company that offers a greater coverage variety.

Home insurance will often cover accidents you or a family member have caused. If another person caused the damage, such as a neighbor or passerby, their insurance will cover the repair expenses. Your insurance should cover damage that fire or vandalism causes. Additionally, your insurance should cover theft incidents or hit-and-run scenarios.

Some natural disasters will exclude your garage from home insurance, as extreme weather can be challenging to predict. Although your company may cover partial costs from wind-blown debris or hail damage, some severe damages may not fall under your policy. For example, earthquakes or floods may require you to cover the cost of repairs yourself.

Your insurance company will also likely reject your claim if the damage is due to natural wear and tear over time. As a homeowner, you do have to cover the maintenance and repair for your home out of pocket in such a case. Insurance companies take the responsibility of a homeowner to take care of their own home into account with their policies.

Does Car Insurance Cover Garage Doors?

If you or someone else damages your garage door with a car, you may be able to file a claim with your auto insurance company. Many of us have been there — a busy morning, we’re rushing out of our homes, and we’re feeling scatterbrained. Forgetting to open the garage door — and even backing right up into it — can happen. Or maybe you’re coming back home, the door isn’t opening as quickly as you guessed, and you scrape the bottom of it pulling into your garage. Accidents happen. That’s what insurance is for!

Unfortunately, your car insurance does not cover hitting your garage door if you were the one to cause the damage. Your attached garage is a piece of your home that falls under different insurance. However, car insurance should cover the cost of repairs for your car from the accident.

Additionally, if another person’s vehicle caused the accident, that person’s collision insurance may cover the repairs you need for your garage. Similarly, your auto insurance should cover damage you make to another person’s garage if you back or run into it.

Does Renters Insurance Cover Garage Doors?

As a renter, the garage door is not your property or responsibility. Renters insurance protects your belongings but does not cover structural damage. Although your renters insurance will cover stolen or damaged belongings, it will not cover the garage door and other structures on the property.

In the event of an accident that you did not cause, your landlord will need to contact his provider and discuss repair options. However, if you cause damage to the door, you will need to cover the costs out of your pocket. Your auto insurance may cover your car damage but will not cover garage damage.

Filing a Homeowners Claim for a Damaged Garage Door

Filing a claim for your garage door should be simple, but it can become complex depending on the situation. Your first step should be to contact your provider to determine whether your garage door is in your policy. You will then need to disclose who is to blame for the accident, whether it was someone in your family, a third party, a fire or something else.

You will need to submit documentation that is related to your claim. Depending on the accident, you may need to submit different documents. For example, a crime such as arson or vandalism will likely require you to submit a police report. Other times, your insurance company may require you to send receipts for repairs or send an adjuster to determine repair costs.

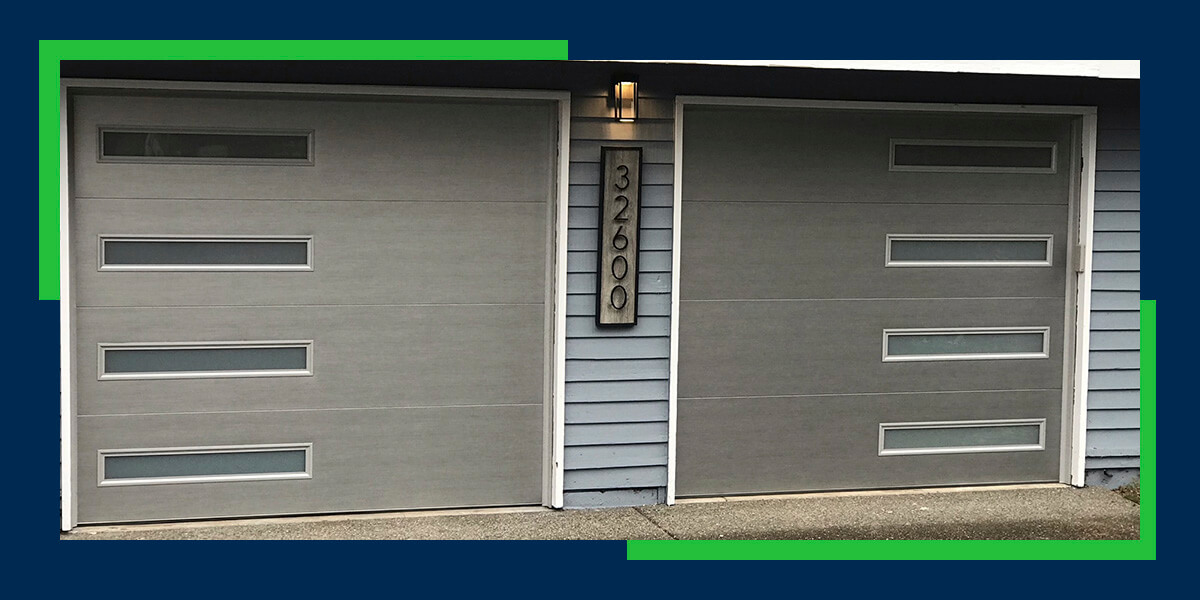

Repair Your Garage Door With DistribuDoors

If one of these situations or any other that involves your car and damage to your garage door occurs, you may be able to cover the costs to fix the door by filing an insurance claim. When your garage door gets damaged or broken, you’ll want to have it fixed as soon as possible. That’s where we come in.

DistribuDoors operates in the greater Seattle area. Our team is full of some of the most knowledgeable people in the industry, and our service is top-tier. We offer comprehensive service, products and installation, so you can always feel confident when you work with us.

Choose DistribuDoors to take care of any of your Seattle area garage door repair and maintenance needs. Contact us to learn more about our services or schedule an appointment.